|

Date: 25/09/2012

Agritrade Resources plans to invest US$50 million to increase production, improve road and infrastructure

By: Finet

Synopsis : According to an interview with the Manfred, the Company plans to increase its annual production of SEM coal to 6 million tonnes by 2014 – 2015. The Company will focus on the improvement of infrastructure. In terms of Capex, USD 50 million will be invested to increase production capacity, which will be funded by internal cash resources. The company does not have pressure on cash flow, but will consider bank loans.

Source

Date: 25/09/2012

Falling international coal prices have limited impact on Agritrade Resources low calorific coal

By: Finet

Synopsis : Due to the recent drop in international coal price, the Company will consider to reduce the amount of loan, based on a USD 50 million agreement set up earlier this year. Manfred also emphasizes that the drop in coal price will mainly affect high kcal coal, while Agritrade produces low kcal coal, it has limited effect on the company.

Source

Date: 25/09/2012

Agritrade Resources to explore new market once upgrading technology matures in 1-2 years

By: Finet

Synopsis : In the future, 30-40% of the coal will be exported to China. The company might also consider developing Korean and Japanese market in 1-2 years, when upgrading technology matures.

Source

Date: 20/08/2012

China India Continue To Fuel Demand For Affordable Coal Supply

By: Channel News Asia

SINGAPORE: Hong Kong-listed Indonesian coal mining company Agritrade Resources said demand for cheap energy alternatives from developing economies is not expected to wane. It supplies "sub-bituminous coal" - or lower grade thermal coal - which is seen an affordable source of energy for developing nations. It said China and India - the first and second largest importers of Indonesian coal since 2009 - are the key growth markets for its coal. It's also looking to expand its customer base in the domestic Indonesian market. Chief operating officer of Agritrade Resources Limited, Ng Xinwei, said: "Our main markets are for developing nations such as India, China, that require alot of cheap energy in order to develop their nation. As along as the company sticks to its core strategy of lowering our production cost, and increasing our volumes, we don't see any problems in posting good growth and good profits in the years to come." Agritrade has increased its coal production capacity by five-fold, to almost 1.6 million tonnes this year. It's looking to increase its production and reserves capacity by further exploring the remaining 1,400-hectares of its mine concession. Agritrade is also on the lookout for opportunities to acquire other commercially viable coal assets in Indonesia. It plans to maximise its production efficiency by upgrading its existing logistics and infrastructure facilities to reduce its coal transportation time, and to increase the volume of coal hauled, to lower costs and boost its profitability. To further enhance its profit margins, Agritrade has started building its own coal upgrading facility, to blend, process and upgrade its coal into a higher quality coal. Its coal upgrading facility will have a processing capacity of 500,000 tonnes of upgraded SEM coal per annum, and is expected to be completed by 2013.

Source

Date: 05/07/2012

Agritrade Resources Plan To Expand Production Capacity And Take Larger Orders

By: QuamNews

Agritrade plans to increase its coal production capacity from 1.58 million tonnes (as of 31 Mar 12) to 2-2.5 million tonnes. Chief Financial Officer Manfred Shiu said that this will help Agritrade secure at least one long term coal supply contract. The Company's open cut mine is not expected to involve high capex. Currently the Company's coal is sold through traders mainly to India (over 60%) and China (30%), with the rest sold to markets like Indonesia and Thailand. It hopes to sell to end users directly in the long run. Some individual Chinese companies have also contacted the Company about purchasing its products. The Company will continue to upgrade mining and logistics facilities and infrastructure. It plans to construct 6 coal upgrading facilities with annual Synopsis production capacity of 500,000 tonnes each at an estimated cost of US$55million. The Company expects to incur capex of US$20-30 million over the next 1-2 years, to be funded by internal resources. Agritrade will utilise GEO-COAL technology which upgrades the calorific value of its coal, thereby helping to increase its selling price. The cost of FOB coal is currently US$20 tonnes, and is expected to be reduced by US$5-6 per tonne upon the completion of various logistics infrastructure enhancements. Chief Technology Officer Peter Gunn noted that currently, only 46 hectares out of the Company‟s 2,000 hectares concession has been mined. Manfred Shiu said that the Company aims to increase its reserves from 70 million to 100 million tonnes, and expects to spend US$250,000 on further exploration to increase its coal reserves.

Source

Date: 05/07/2012

Agritrade Resources: Thrid Pit Commences Operations, Confident Of Achieving Production Target

By: ET Net

Article mentions the Company‟s plans to increase its coal production capacity and improve logistics infrastructure. CFO Manfred Shiu said the Company is confident of achieving its production target of 2 to 2.5 million tonnes in 2012 with the opening of the third coal pit. Company aims to produce 6 million tonnes in 2014.

Source

Date:05/07/2012

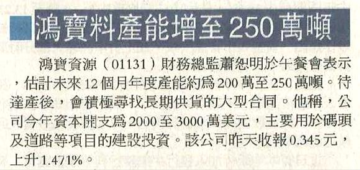

Agritrade Resources: Expects Significant Growth In Annual Production Capacity

Mr. Xinwei Ng, Agritrade‟s COO expects annual production capacity of its SEM coal mine to increase 1 million tonnes to 2.5 million tonnes by the end of this year. Along with the growth in capacity, the Company hopes to sign on long term supply contracts with PRC or Indonesian customers to secure a stable and higher income. CFO Manfred Shiu added that Agritrade targets to increase its annual SEM coal production capacity to 6 million tonnes by 2014, through improving logistics facilities. Capex is estimated at US$20-30 million this year on the enhancement of mining processes, coal hauling road and jetty facilities. The full operation of mine pit 2 and 3 are expected to boost production. Manfred noted that production cost could fall by US$5 per tonne (currently US$20 per tonne) upon the completion of the upgrading of the coal hauling road. The Company will finance these investments by internal resources. Agritrade reported a loss for the year of HK$17.624 million and a loss per share of HK$3 cents. The Company recorded profit of HK$44.125 million last year. The Company does not recommend the payment of dividend.

Date: 05/07/2012

Agritrade's Loss Affected By Accounting Items

The management explained that the drop in profit for FY2012 was mainly impacting by non-cash accounting items. In terms of operations, Agritrade is achieving steady growth. As the Company‟s coal production capacity increase, it will strive to secure long term contracts with power plants for the direct supply of coal to further drive business growth. The management plans to further increase its coal reserves to decrease amortisarion cost, and plans to discuss with key shareholders on converting their convertible bonds to reduce finance cost. Agritrade‟s production capacity grew 5 fold to 1.58 million tonnes in FY2012; coal reserves increased 72% to 70.7 million tonnes.

Date: 05/07/2012

Agritrade: Confident About Greatly Expanding Production Capacity

The Company said it is confident about increasing its production capacity from 2 million tonnes to 2.5 million tonnes this year. It hopes to achieve 6 million tonnes by 2014. Primary goal for this year is to improve logistics and infrastructure. Chief Technical Officer, Mr. Peter Gunn, said being affected by the global economic environment, coal prices currently demonstrate a downtrend. Coal price at Australia is US$70 per tonne. He believes that demand in China and Indonesia remain strong and that in the long run, coal price will rise to US$100 per tonne.

Date: 05/07/2012

Agritrade Plans To Increase Production Capacity To 2.5 Million Tonnes

Agritrade plans to increase production capacity to 2.5 million tonnes Manfred Shiu, CFO of Agritrade Resources said that the acquisition of LME by HKEx is expected to provide a better platform for hedging. Agritrade plans to increase its production capacity to 2.5 million tonnes and hopes to sign on long term coal supply contrafcts with its end users.

Date: 05/07/2012

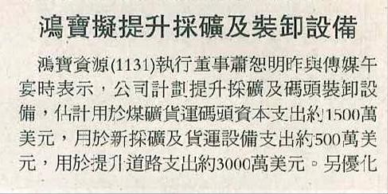

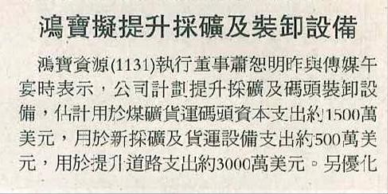

Agritrade Plans To Improve Mining Infrastructure And Loading Facilities

Manfred Shiu, the Company‟s CFO expects to spend US$1.5 million on the construction of the jetty, US$5 million on new mining and transport equipment, and US$30 million on upgrading the coal hauling road. It will also build up to six coal upgrading facilties at US$5 million each.

Date: 05/07/2012

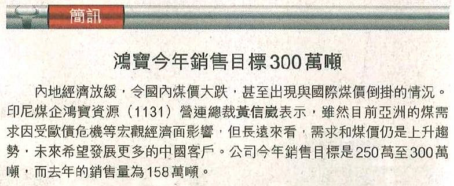

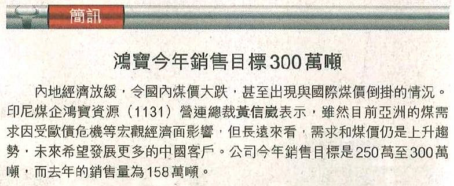

Agritrade Aims To Sell 3 Million Tonnes Of Coal This Year

Mr. Xinwei Ng, COO of Agritrade Resources said that in the long run, coal prices will still demonstrate an uptrend. Agritrade‟s sales target for this year is 2.5 to 3 million tonnes, compared to sales volume of 1.58 million tonnes in FY2012.

Date: 05/07/2012

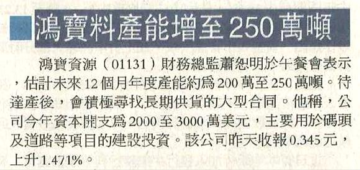

Agritrade To Increase Production Capacity to 2.5 Million Tonnes

Manfred Shiu, CFO of Agritrade said the Company plans to increase its coal production capacity from 2 million tonnes to 2.5 million tonnes. The Company is also actively looking to sign on long term coal supply contracts with end users.

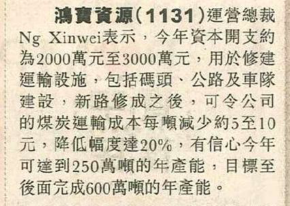

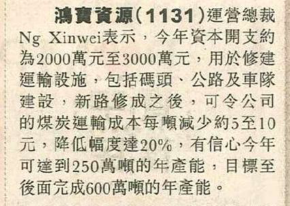

Date: 05/07/2012

News Flash

Mr. Xinwei Ng, COO of Agritrade Resources said the Company will incur US$20-30 million in capex on the enhancement of its jetty, roads and truck fleet. Upon the completion of the new coal hauling road, the Company could save US$5-10 in transportation cost per tonne of coal. It is on track to increase coal production to 2.5 million tonnes.

|